1031 Exchanges: A Tax-Deferred Strategy for Real Estate Investors

When it comes to maximizing your real estate investment portfolio while minimizing your tax liabilities, few strategies are as powerful as the 1031 exchange. Named after Section 1031 of the Internal Revenue Code, this tool allows investors to defer capital gains taxes on the sale of investment properties by reinvesting the proceeds into another qualifying property. Let’s dive into the ins and outs of 1031 exchanges, including what they are, why you should consider one, the rules, and the types of properties that qualify.

What is a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, allows real estate investors to defer paying capital gains taxes on the sale of an investment property, as long as the proceeds are used to purchase a similar or “like-kind” property. This deferral means you can leverage your entire investment, including the capital gains, to acquire new property, thereby accelerating your portfolio’s growth.

Why Consider a 1031 Exchange?

Here are some of the top reasons why savvy investors use 1031 exchanges:

-

Tax Deferral: By reinvesting the proceeds from the sale of your property into another qualifying property, you postpone capital gains taxes, potentially saving tens or even hundreds of thousands of dollars.

-

Portfolio Diversification: A 1031 exchange allows you to pivot into different types of real estate investments or new geographical areas without the immediate tax burden.

-

Income Potential: Swap an underperforming property for one with greater income potential, such as moving from residential rentals to commercial properties or vacation rentals.

-

Estate Planning Benefits: If you hold onto a 1031 exchange property until your death, your heirs inherit the property at a stepped-up basis, effectively eliminating the deferred tax liability.

Rules of 1031 Exchanges

While the tax advantages are significant, 1031 exchanges come with strict rules and timelines that must be followed to qualify:

-

Like-Kind Property: The property you sell and the one you purchase must be of like kind, which broadly means they must both be held for investment or business purposes.

-

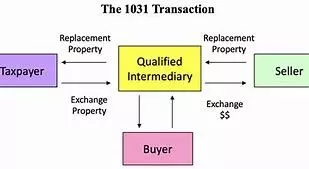

Qualified Intermediary (QI): You must use a QI to facilitate the exchange. You cannot take possession of the sale proceeds, even briefly, or the exchange will be disqualified.

-

Identification Period: You have 45 days from the sale of your property to identify up to three potential replacement properties in writing. Only these properties qualify for the exchange. Restrictions apply to investors who wish to identify more than three properties.

-

Replacement Period: You must close on the replacement property within 180 days of selling your original property.

-

Equal or Greater Value: To fully defer taxes, the replacement property must be of equal or greater value than the property sold. Any cash not reinvested (known as “boot”) will be subject to taxes.

-

Same Taxpayer: The entity that sells the property must be the same one that purchases the replacement property.

What Properties Qualify for a 1031 Exchange?

Not all properties are eligible for a 1031 exchange. Here’s a breakdown:

-

Eligible Properties:

-

Residential rentals

-

Commercial properties

-

Industrial properties

-

Vacant land held for investment

-

Mixed-use properties (part residential, part commercial)

-

-

Ineligible Properties:

-

Primary residences

-

Vacation homes not used as rental properties

-

Dealer properties (properties held for resale)

-

Stocks, bonds, or other securities

-

Additional Considerations for a 1031 Exchange

-

Partial Exchanges: You can still do a 1031 exchange even if you’re not reinvesting the full amount. However, any proceeds not reinvested will be taxed as capital gains.

-

Reverse 1031 Exchanges: If you purchase a replacement property before selling your original property, it’s called a reverse 1031 exchange. This type of exchange requires careful planning and the use of a QI.

-

Improvement 1031 Exchanges: This option allows you to use the exchange funds to make improvements to the replacement property, provided they’re completed within the 180-day period.

Is a 1031 Exchange Right for You?

A 1031 exchange isn’t suitable for every investor. The process is complex, and failing to adhere to the rules can result in significant tax penalties. Consulting with a tax advisor, attorney, or 1031 exchange specialist is essential to determine whether this strategy aligns with your investment goals.

Final Thoughts

A 1031 exchange is a powerful tool for real estate investors looking to defer taxes, grow their portfolio, and maximize their wealth. By understanding the rules and working with experienced professionals, you can unlock the full potential of this strategy and take your real estate investing to the next level. Whether you’re looking to diversify, upgrade, or shift your portfolio, a 1031 exchange might just be the key to achieving your financial goals.

Categories

Recent Posts

GET MORE INFORMATION

Billee Silva, PA, ABR SRS

Licensed Realtor | License ID: P3275278

Licensed Realtor License ID: P3275278