Recession and the Housing Market: What History Tells Us

Recession talk is all over the news, and the odds of a downturn are rising this year. That naturally leaves people wondering what would happen to the housing market if we do go into a recession. Would home prices plummet? Would the market crash like it did in 2008? Let’s take a look at historical d

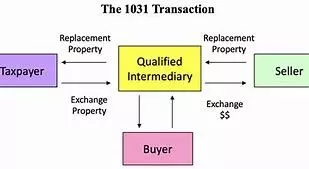

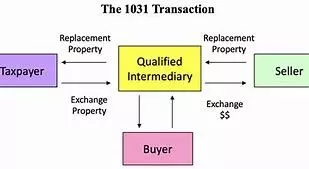

Read More1031 Exchanges: A Tax-Deferred Strategy for Real Estate Investors

When it comes to maximizing your real estate investment portfolio while minimizing your tax liabilities, few strategies are as powerful as the 1031 exchange. Named after Section 1031 of the Internal Revenue Code, this tool allows investors to defer capital gains taxes on the sale of investment prop

Read More-

When it comes time to sell your home, you want potential buyers to see not only the property but also the care and attention you’ve given it over the years. One way to impress future buyers and make your home stand out is by creating a brag book. This simple yet effective tool can help showcase you

Read More Declutter Your Kitchen in Just 10 Minutes: Simple Tips for a Clean, Efficient Space

The kitchen is often the heart of the home, but it can easily become cluttered with everyday items. Whether it's a pile of mail, snacks, or small appliances taking up valuable counter space, a cluttered kitchen can make cooking feel more like a chore. The good news is that you can declutter your ki

Read More

Categories

Recent Posts