6 Essential Tips for Choosing the Right Mortgage Lender

If you're buying a home, choosing the right mortgage lender is one of the most important decisions you'll make. A great lender can help you get approved faster, secure a competitive mortgage rate, and guide you through the process with less stress. But with so many mortgage lenders out there, how d

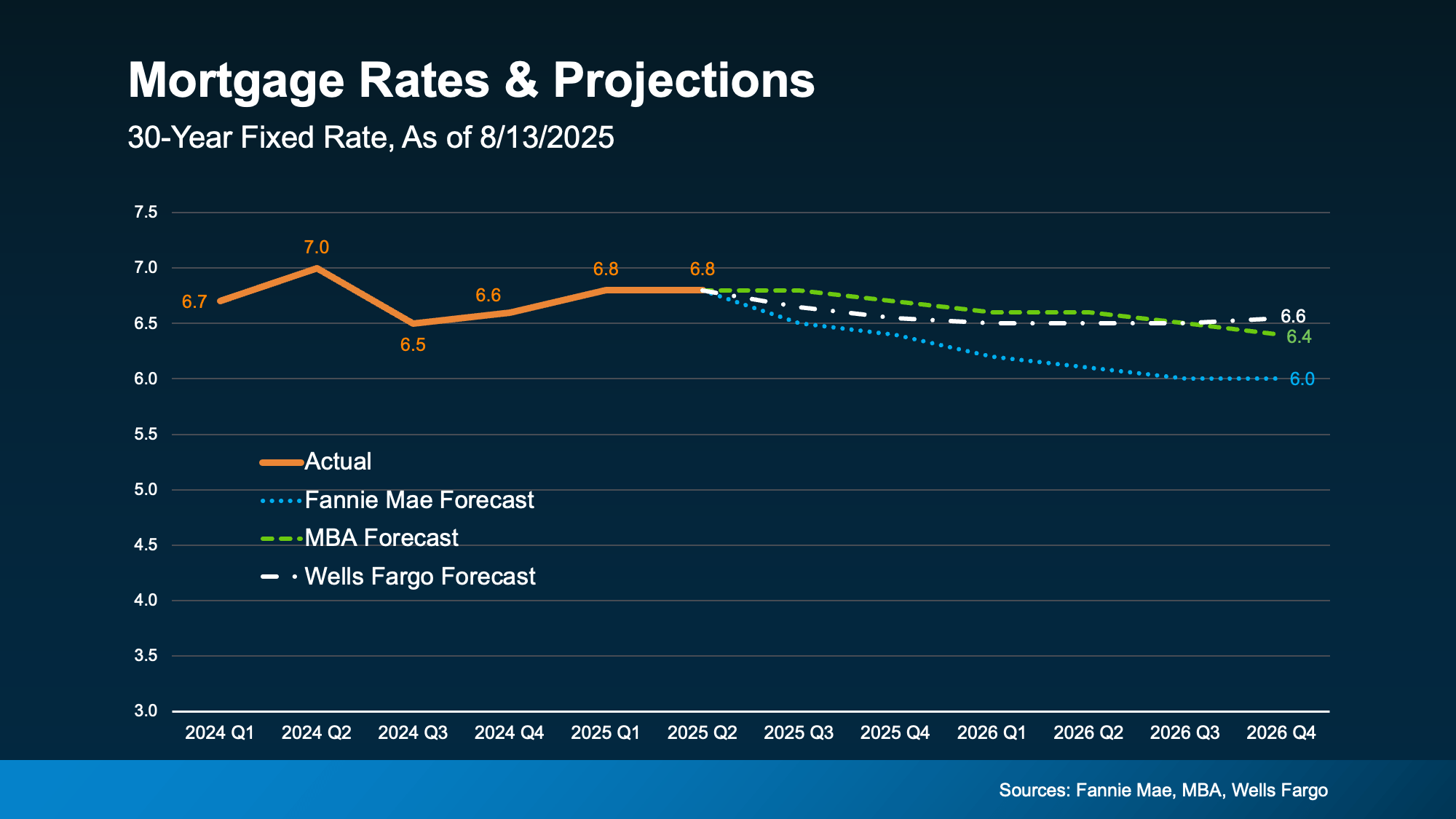

Read MoreIs It Better To Buy Now or Wait for Lower Mortgage Rates? Here’s the Tradeoff

Mortgage rates are still a hot topic, and for good reason. After the most recent jobs report came out weaker than expected, the bond market reacted almost instantly. And, as a result, in early August mortgage rates dropped to their lowest point so far this year (6.55%). While that may not sound li

Read MoreWaterfront Living at Tarpon Point Marina in Cape Coral, Florida

If you’re dreaming of a Southwest Florida lifestyle where every day feels like a vacation, Tarpon Point Marina in Cape Coral, Florida, is the place to be. This exclusive waterfront community offers luxury living, world-class boating, and an unmatched coastal vibe, all just minutes from the Gulf of

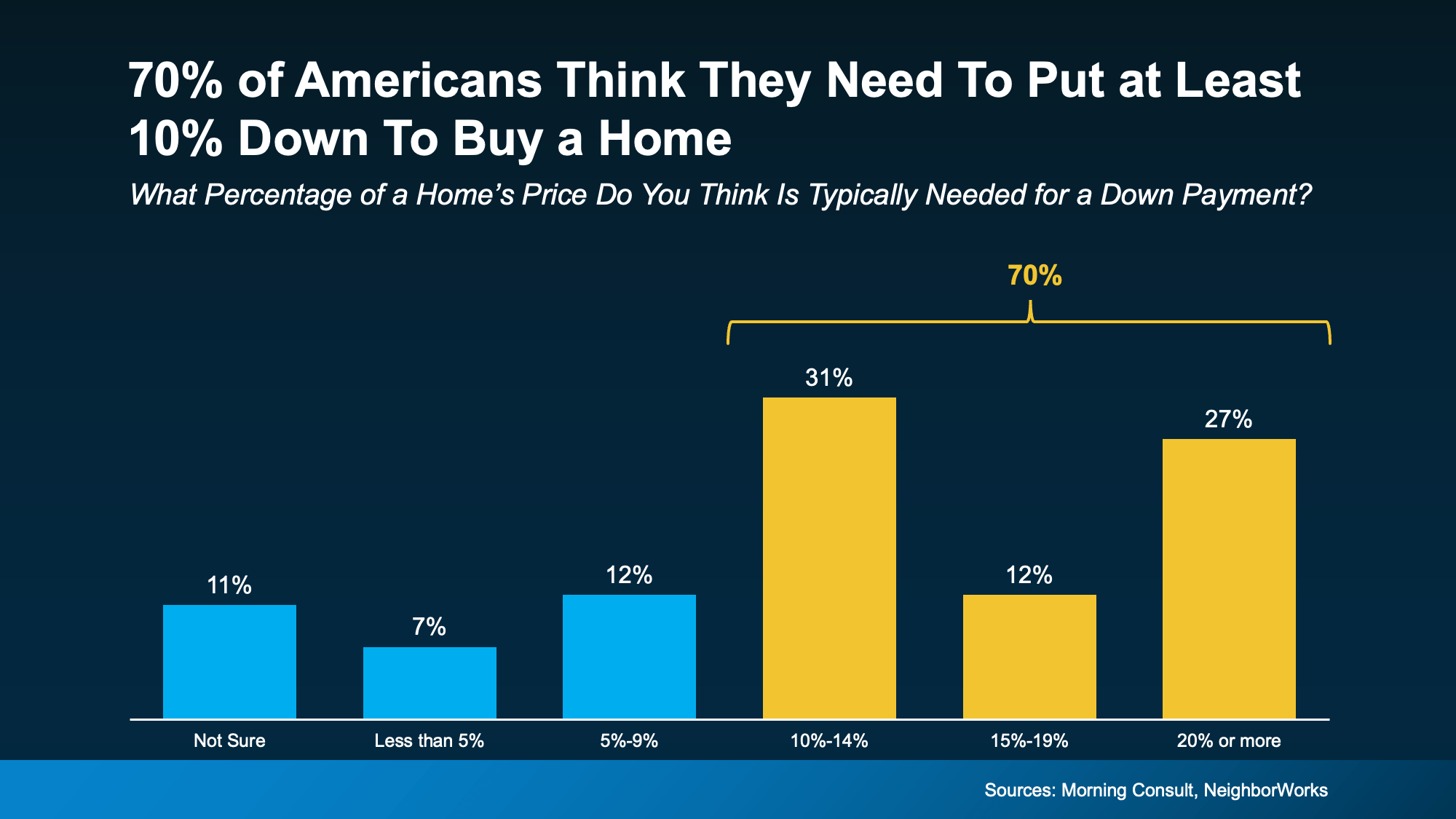

Read MoreThe Truth About Down Payments (It’s Not What You Think)

Buying a home is exciting… until you start thinking about the down payment. That’s when the worry can set in. “I’ll never save enough.” “I need a small fortune just to get started.” “I guess I’ll just rent forever.” Sound familiar? You’re not alone. And you’re definitely not out of luck. Here’s the

Read More

Categories

- All Blogs 331

- 55+ Communities 9

- Boating Communities 9

- First Time Home Buyer 106

- Florida Lifestyle 66

- Foreclosures 2

- Fun Things to do in Lee County, Florida 36

- Golf Communities 22

- Home Buyer Tips 121

- Home Seller Tips 100

- Homeowner Tips 61

- Mortgage Tips 36

- Neighborhoods 60

- Schools 3

- Title & Escrow 2

- Title Insurance 4

Recent Posts